Lunar Year For Zakat

The first zakat payment will become due twelve lunar months after the child reaches the age of puberty if they possess wealth above the nisab.

Lunar year for zakat. 355 days of having the ownership of cash by the proprietor. Is the Zakat Due Date ZDD flexible. Please check the applicable Nisab level on your Zakat Due Date.

Those who pay Zakat according to the solar year should accordingly in order to take into account the difference in days add 3 to the amount of Zakat payable. With regard to calculations and specific information throughout this flyer we have followed the opinion of the Hanafi school of thought. Completion of the Lunar Year.

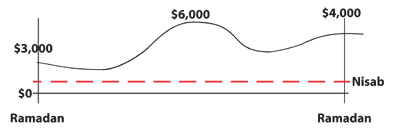

This will be your seed date whenever it comes around you will have to calculate zakat irrespective of any fluctuations in the amount of wealth in your possession. Thus to say that the passage of a lunar year is required on all zakatable wealth is incorrect. But in actual fact Mr Bakr must pay Zakat on R 10000 because the debts were incurred only after his Zakat became due on the R 10000 hence the debt of R 4000 cannot be employed to offset Zakat payment in that sumAt the end of the Islamic year Mr Ahman had Zakat taxable wealth for the amount of R 100 which is below Zakat.

As long as you are in possession of wealth above the nisab threshold at the beginning and end of the zakat year zakat will be payable even if your wealth dipped below the nisab for most of the year. Nisab is closely connected with Hawl ie. Giving Zakat is obligatory for all eligible Muslims and is based on the current nisab values.